The Banking industry is rapidly changing and the biggest paradigm shift that has occurred is the move to digitalizing-banks only. With the combination of data and advanced analytics allow Banks to build personalized relationships that could be more powerful than ever possible.The world is going through the biggest transformations- The FinTech revolution. The FinTech revolution will be transforming banking industry today. Bankers in the future will be very different from the banking today- The personalities to skillsets, cannot be compared to the bankers of today.

Is your Bank catching the FinTech Wave?

Using old technologies, your bank is going nowhere. To be a part of the banks of the future and for your bank to evolve, your bank needs to be able to adapt quickly to integrate with some of the external microservices.

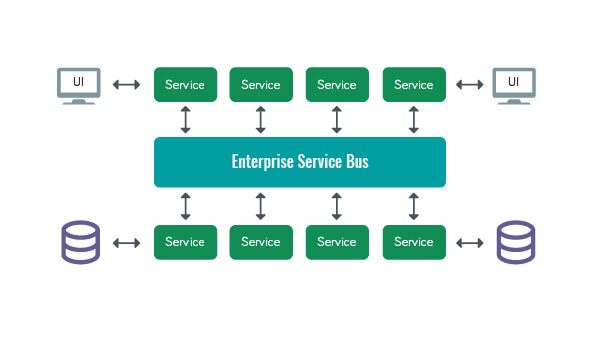

Currently, most banks are still tied up to their Enterprise Service Bus (ESB). ESBs came about from the need to manage protocols. While ESBs served their purpose and were able to reduce costs for many incumbent organizations, focusing on back-end integration and orchestration would NOT lead to digital transformation success. ESBs were inherently built for heavy weight architectures for initiatives that take months. ESB is not a consumption strategy, not built for speed and scale.

Why ESBs won’t allow your bank go big on Digital?

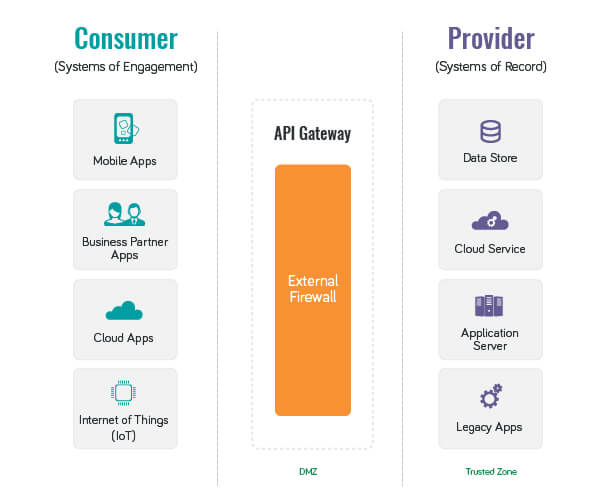

A general rule of thumb to note is that when services are exposed to the outside world, an API gateway is a tool to be considered. It is positioned outside of the Intranet, typically in the DMZ. It manages only the subset of services that is communicating with external parties. An ESB is used for service virtualization, typically manage a much larger set of services, and is positioned inside the Intranet.

Moreover,

- ESB’s are code-centric: ESBs are defined by complex coding for legacy systems integration. This is great for stability, but not friendly to mobile app developers who are trying to help your digital transformation efforts.Slow by nature: The fact that ESB runtime must take full scale composition and degrees of statefulness is a design feature of the execution engine. This is what keeps the backend running smoothly despite such complex connections between systems. However, ESB runtime design makes it very difficult to optimize for throughput. Moreover, it becomes difficult to roll out new microservices.Cannot Externalize: Digital transformation implies a deeper level of third-party integration, regardless of the project you’re executing. ESBs don’t provide external threat protection that is necessary for security and new digital solutions.Complex management: Your legacy systems require specially trained employees for management and maintenance. The cost of overhauling ESB-integrated systems would be significant when consider time and costs associated with delivering digital services.If your bank is looking to succeed with digital transformation, you need a simple, fast, and secure way to access, model and present using open standards the functionality in the target systems so you can better-enable transaction processing between various aspects of your bank.An effective Digital Banking Platform which is designed especially for the banking and finance industry to ride the FinTech wave, is a perfectly safe choice today to consider.

Why does YOUR bank need a hSenid’s Digital Banking Platform?

The critical challenges and issues for today’s Banks are striving to increase efficiency, the ability to react quickly to market changes, customer satisfaction and new improved revenue streams.

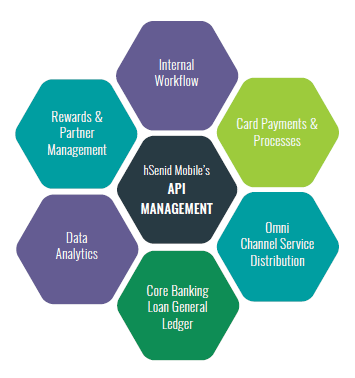

Banks are in need of a digital service creation platform, which can interconnect various stakeholders, partners system, service distribution and internal processes.An API Management platform will be the appropriate suite solution, as it can overcome two key restrictions in Banking & Financial Services; Limitation in Financial Service Infrastructure and enhancing service innovation through data sharing and partnership alliance.Characteristics of hSenid’s Digital Banking Platform that would help Banks to digitally transform quickly are:

- Consumption-centric: Enables 3rd party microservices to seamlessly integrate.Rooted in agility: To be able to help banks adapt quickly to customer demands by rolling out new services.Fast to adopt new business models: Can quickly address an Open Standard based exchange format.Security in mind: Digital Banking Platform is designed to be fast, secure, robust and scalable. As you integrate with third parties and make your internal legacy systems more outward-facing, your bank is opening yourself up to a world of cyber threats. With the effective Digital Banking Platform, you can ensure your backend systems of record are safe.Control: Can set control measures over all banking activities even though it has externalized.Self Service & reporting: Our Platform can be open to self-servicing, allowing customers to access and view their own information. Customers can also generate reports of their banking activities.